Entrepreneurs and investors struggle to evaluate new ventures. Entrepreneurs are challenged to justify valuation. Investors are challenged to compare diverse investment opportunities and quantify the required return given a particular level of risk. The Right Start Venture Risk Profile℠ helps identify the risk factors most likely to impact a new business venture.

Entrepreneurs and investors struggle to evaluate new ventures. Entrepreneurs are challenged to justify valuation. Investors are challenged to compare diverse investment opportunities and quantify the required return given a particular level of risk. The Right Start Venture Risk Profile℠ helps identify the risk factors most likely to impact a new business venture.

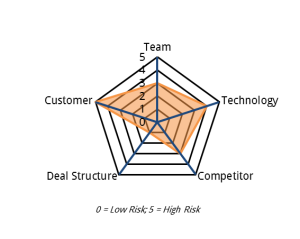

The Right Start Solution: The Venture Risk Profile℠ analyzes new and established organizations across five central risk factors: Team, Customer, Competitor, Technology, and Deal Structure. Each risk factor is evaluated scored on a quantified scale. Given the investor’s risk tolerance and return targets, the Venture Risk Profile℠ calculates the required EBITDA and free cash flow targets for the venture. This allows the investor and entrepreneur to derive the optimal pre-money valuation.

For Entrepreneurs: The Venture Risk Profile℠ identifies high risk areas of the business, allowing the entrepreneur to concentrate efforts on areas where risk reduction most significantly improves pre-money valuation. The mitigation of high risk areas will increase valuation and increase the probability of attracting qualified investors.

For Investors: The Venture Risk Profile℠ normalizes the evaluation of businesses across different stages of their lifecycles and across different industries and business models. This facilitates the comparison of different deals based on their risk-adjusted returns so that capital may be deployed to the opportunities with the highest potential for a significant return.

Please contact us to learn more about Right Start’s Venture Risk Profile℠.